Boise Home Builders and Your Construction Options

Choosing the Right Builder and Community

Finding the perfect builder and community is your first crucial step in the exciting journey of constructing your dream home in the Treasure Valley. With over 100 active builders to choose from, this can seem like a daunting task, but it doesn’t have to be. Jennifer Louis, a highly recommended realtor with expertise in relocation, is here to help. Here is your guide of Boise Home Builders and your construction options to get started.

Exploring Home Builder Types

When embarking on the journey of building a new home, one of the fundamental decisions you’ll need to make is selecting the right type of home builder to suit your preferences and needs. Here, we delve into the three primary categories of home builders, each offering a distinct approach to the art of home construction:

1. Production Builders

Production builders are renowned for their efficiency and streamlined processes. These companies specialize in constructing a range of homes based on the same set of floorplans. This repetition allows them to create consistent, high-quality homes. However, there’s a trade-off. While production builders often provide a multitude of options and upgrades, these typically come at a premium. In the pursuit of efficiency, the client experience may sometimes be less personalized compared to other builder types. There are various price ranges and community types with production builders in Boise and the surrounding Treasure Valley. Depending on the production builder you choose you may have less participation in customizing the home. CBH Homes is one of the largest production builders in the Valley and they offer minimal options to customize. They became a spec home builder several years ago during the Boise Boom and removed most options that a homeowner can choose in new construction. They still offer options for landscape and fencing in some of their communities and you can often upgrade to include their window coverings and appliances or negotiate to have these included in the contract price.

2. Semi-Custom Builders

Semi-custom builders strike a balance between the convenience of pre-designed floorplans and the flexibility to make modifications. Clients can choose from a selection of floorplans but also have the opportunity to personalize finishes and amenities to better suit their tastes and requirements. What sets semi-custom builders apart is their increased level of client interaction. They tend to be more hands-on throughout the construction process, often having superintendents on-site to oversee the project, ensuring that your vision is brought to life. Brighton Homes is a good example of a semi-custom home that is popular with homeowners in the Treasure Valley. They have been around for nearly 30 years and have built-in many popular subdivisions and parts of the Treasure Valley.

3. Custom Home Builders

For those seeking a truly unique and personalized home, custom home builders are the answer. They are dedicated to crafting one-of-a-kind homes tailored to the individual preferences and requirements of each client. Unlike other builder types, the price and size of the home do not determine whether a builder is considered custom. Many builders claim to offer custom services, but only a select few can genuinely be classified as custom home builders. In this category, clients typically purchase a lot, collaborate closely in designing their dream home, and then engage a builder to bring their vision to life. While custom home construction offers the highest level of personalization, it’s important to note that it’s often the most expensive route to homeownership. There are many custom builders to choose from, for example, Shadow Mountain Homes which has been building luxury homes in the Boise, Idaho area for nearly 30 years.

In summary, choosing the right type of home builder is a pivotal decision in your home-building journey. Your selection will significantly influence the design, cost, and personalization of your dream home, so consider your priorities and budget carefully before making a choice.

Why Jennifer Louis is Your Key to Success

Jennifer has an extensive track record of working with numerous builders in the area. Her firsthand experiences and client feedback from those who’ve had homes built or purchased under construction are invaluable. She’ll expertly match you with the right builder and community, ensuring you start on the right path.

If you are coming from out of state you will start with in-depth video consultations to get a feel for the area and where you may want to begin. Based on your criteria and the initial consultation you will be sent a list of builders and homes under construction to start viewing floorplans and communities online. She will then start registering you as her client with the builders and getting the communication started for your first tour through the community and homes. If visiting in person is not an option Jennifer will work on your behalf providing you with detailed information to make the right home selection from afar. This support covers everything from touring homes that align with your preferred floorplans and model homes to reviewing all contracts and composing addendums. She’s skilled at negotiating terms, attending design appointments, and overseeing inspections, ensuring the builder delivers as per the contract.

Jennifer Louis is your trusted partner in making your dream home in the Treasure Valley a reality. Contact her today to set up a free consultation to get you matched up with the right builder in the right community or area in the Boise area.

If you are considering relocating to Boise and the surrounding area and buying a home I offer a free, no-obligation consultation and will help you start the home-buying process in Boise. In the meantime, make sure to follow me, Jennifer Louis, Boise Metro Real Estate Expert, and local relocation guide on Instagram, Facebook, or my blog for fun facts about Boise and of course a few things real estate. (208) 509-9122 or [email protected].

If you are considering relocating to Boise and the surrounding area and buying a home I offer a free, no-obligation consultation and will help you start the home-buying process in Boise. In the meantime, make sure to follow me, Jennifer Louis, Boise Metro Real Estate Expert, and local relocation guide on Instagram, Facebook, or my blog for fun facts about Boise and of course a few things real estate. (208) 509-9122 or [email protected].

There are several reasons an individual or a family decides to rent a home or apartment. Some, are only in Boise temporarily and need housing for only a year or two. It could be they are still in College and don’t have any credit built up or funds needed to purchase a home and renting is a more realistic option. It could also be they just moved here from out of State and want to get a better feel for the area before committing to buying a home. Some believe that buying a home is just not possible after watching home prices go up year after year in and around Boise. Whatever the reason renters all face the same struggle when looking for a home or apartment to rent in Boise, low inventory. This means there are fewer places to rent than renters seeking a place to call home. The supply vs demand has driven up the prices in Boise and the surrounding Treasure Valley over the past few years making renting more challenging than in the past.

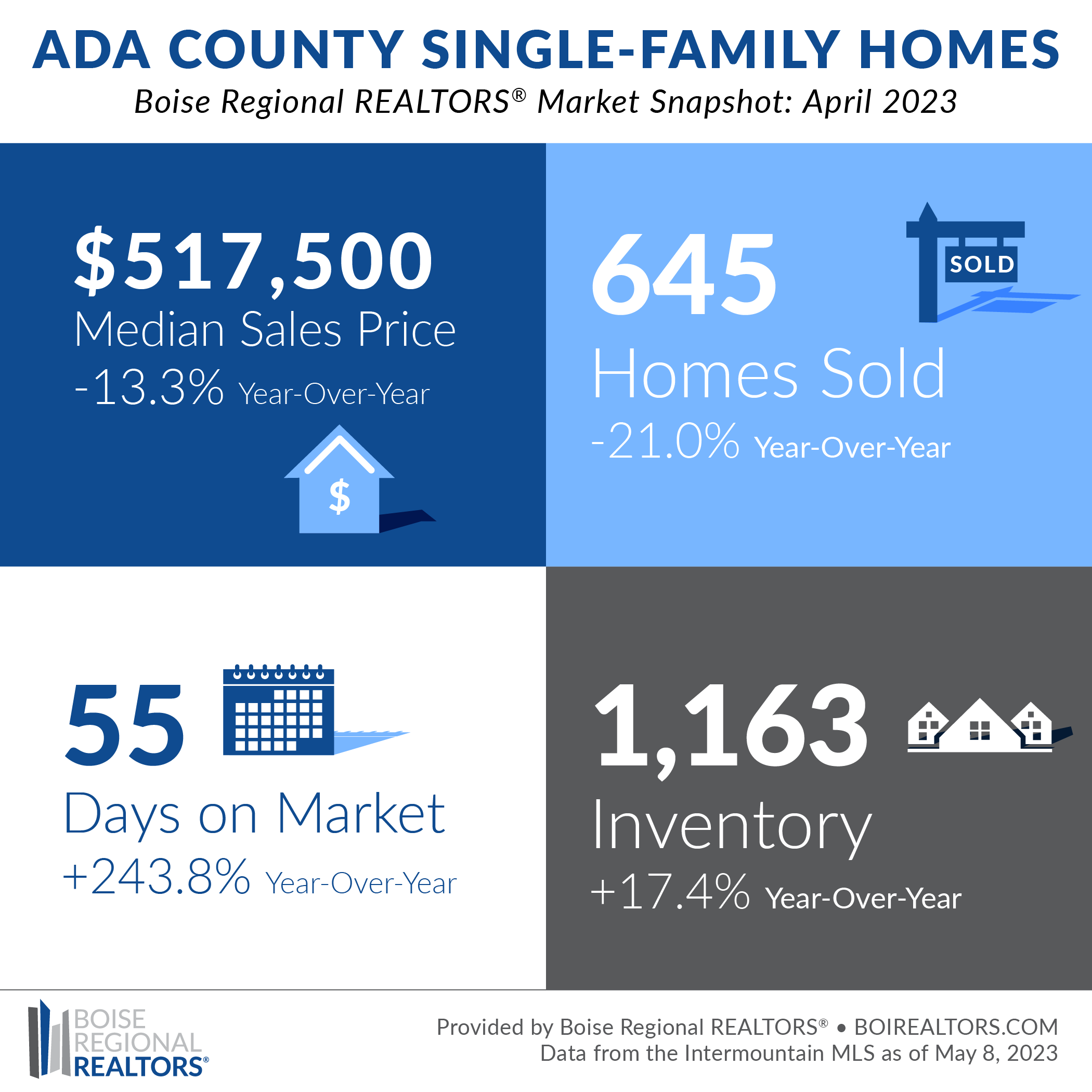

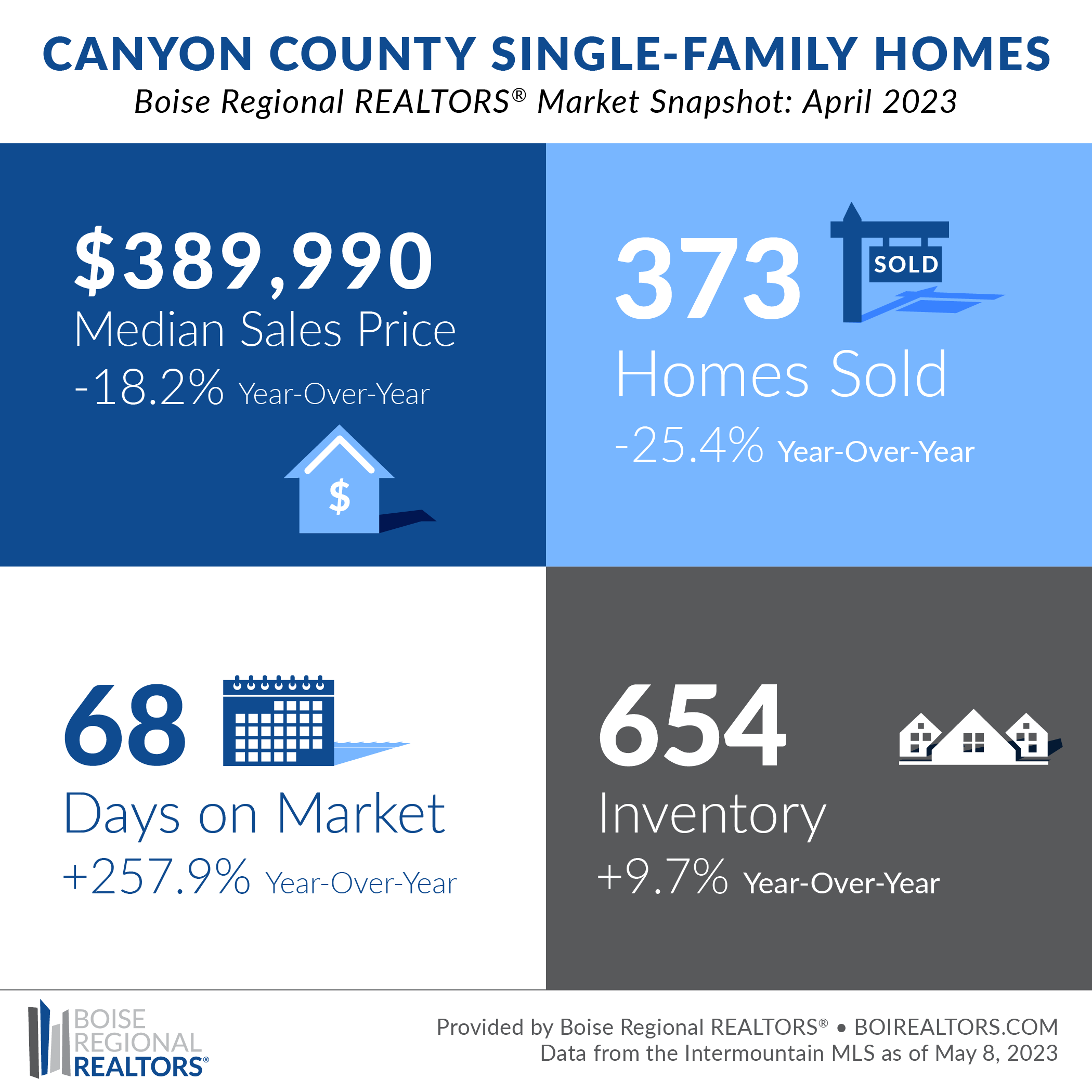

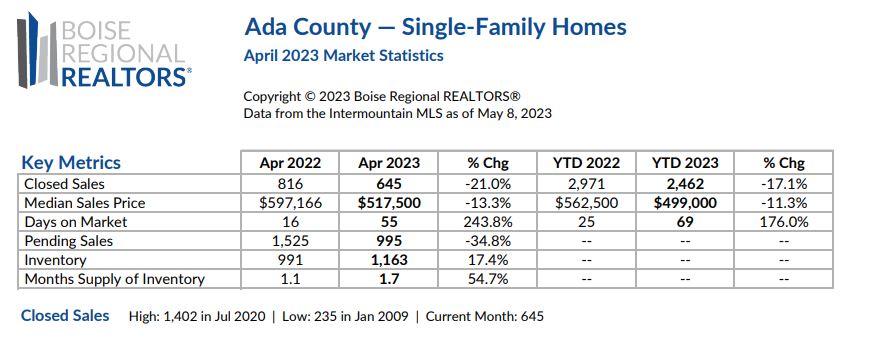

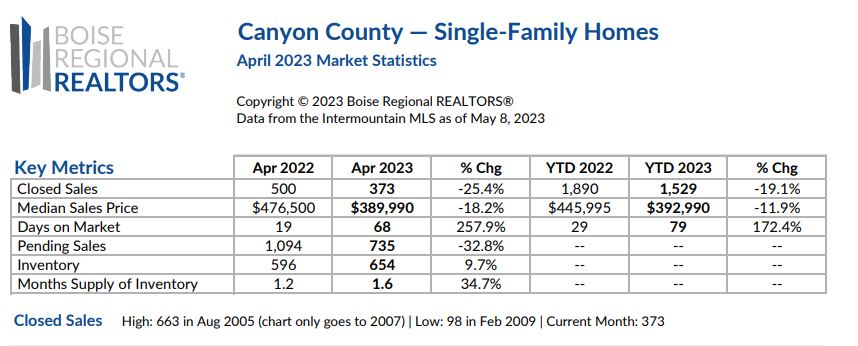

There are several reasons an individual or a family decides to rent a home or apartment. Some, are only in Boise temporarily and need housing for only a year or two. It could be they are still in College and don’t have any credit built up or funds needed to purchase a home and renting is a more realistic option. It could also be they just moved here from out of State and want to get a better feel for the area before committing to buying a home. Some believe that buying a home is just not possible after watching home prices go up year after year in and around Boise. Whatever the reason renters all face the same struggle when looking for a home or apartment to rent in Boise, low inventory. This means there are fewer places to rent than renters seeking a place to call home. The supply vs demand has driven up the prices in Boise and the surrounding Treasure Valley over the past few years making renting more challenging than in the past. For those looking to make a Boise home on a more permanent basis, buying is a more popular option, but there are challenges as well. First, home prices have gone up substantially over the past five years in the Treasure Valley, and with higher interest rates we are now seeing some potential buyers priced out of the market. The median price of a home in Ada County is around $490,000, coupled with interest rates hovering around 7% many have backed away from buying a home and are waiting until rates come back down. There are also those who would like to buy, but don’t have high enough credit or long enough employment history to qualify for a loan on a home.

For those looking to make a Boise home on a more permanent basis, buying is a more popular option, but there are challenges as well. First, home prices have gone up substantially over the past five years in the Treasure Valley, and with higher interest rates we are now seeing some potential buyers priced out of the market. The median price of a home in Ada County is around $490,000, coupled with interest rates hovering around 7% many have backed away from buying a home and are waiting until rates come back down. There are also those who would like to buy, but don’t have high enough credit or long enough employment history to qualify for a loan on a home. The Bottom-line is, it depends on a person’s short and long-term goals before deciding to rent vs buy a home. For many, in the short-term renting may make more sense for the reasons mentioned earlier in this article, but in the long-term buying a home in Boise in most cases makes more financial sense.

The Bottom-line is, it depends on a person’s short and long-term goals before deciding to rent vs buy a home. For many, in the short-term renting may make more sense for the reasons mentioned earlier in this article, but in the long-term buying a home in Boise in most cases makes more financial sense.

These are items that could potentially cause a safety issue to the home such as faulty wiring, gas leak, roof issues, sick/dying trees close to homes or repairs that could potentially cost over $1000 to repair such as HVAC, roof, plumbing, mold remediation, electrical, foundation issues and sewer line pipe cracks, etc. Most homeowners if aware of these issues would most likely take care of any of the above issues if it was brought to their attention so it is reasonable for buyers to want these items repaired as well. The only exception would be if a homeowner was aware of a high price item before listing and discloses it to the potential buyer and prices the home accordingly.

These are items that could potentially cause a safety issue to the home such as faulty wiring, gas leak, roof issues, sick/dying trees close to homes or repairs that could potentially cost over $1000 to repair such as HVAC, roof, plumbing, mold remediation, electrical, foundation issues and sewer line pipe cracks, etc. Most homeowners if aware of these issues would most likely take care of any of the above issues if it was brought to their attention so it is reasonable for buyers to want these items repaired as well. The only exception would be if a homeowner was aware of a high price item before listing and discloses it to the potential buyer and prices the home accordingly.

In today’s market, it is almost inevitable that the buyer will ask for a repair, service, or credit during their inspection window. As mentioned previously taking care of some of the items that may come up beforehand could save you time, money, and the headache of negotiating with a buyer in a short time window, however, expect there to be some unknowns that pop up on the inspection report, or that the buyer may ask you to cough up some dough towards closing costs. Your agent will tell you during the listing appointment what to expect for your area and the potential costs that an inspection may bring.

In today’s market, it is almost inevitable that the buyer will ask for a repair, service, or credit during their inspection window. As mentioned previously taking care of some of the items that may come up beforehand could save you time, money, and the headache of negotiating with a buyer in a short time window, however, expect there to be some unknowns that pop up on the inspection report, or that the buyer may ask you to cough up some dough towards closing costs. Your agent will tell you during the listing appointment what to expect for your area and the potential costs that an inspection may bring. Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.

Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.