Boise real estate market update August 2024

Navigating the Shifts: Insights for Home Buyers and Sellers

As Boise’s real estate market continues to adjust to broader economic landscapes, several trends are emerging that both buyers and sellers should consider. Here’s a deeper look into how the market has evolved over the past year, considering key factors like selling prices, transaction types, and market velocity.

Take a Look at the Boise Area Real Estate Market Facts and Trends for August 2024

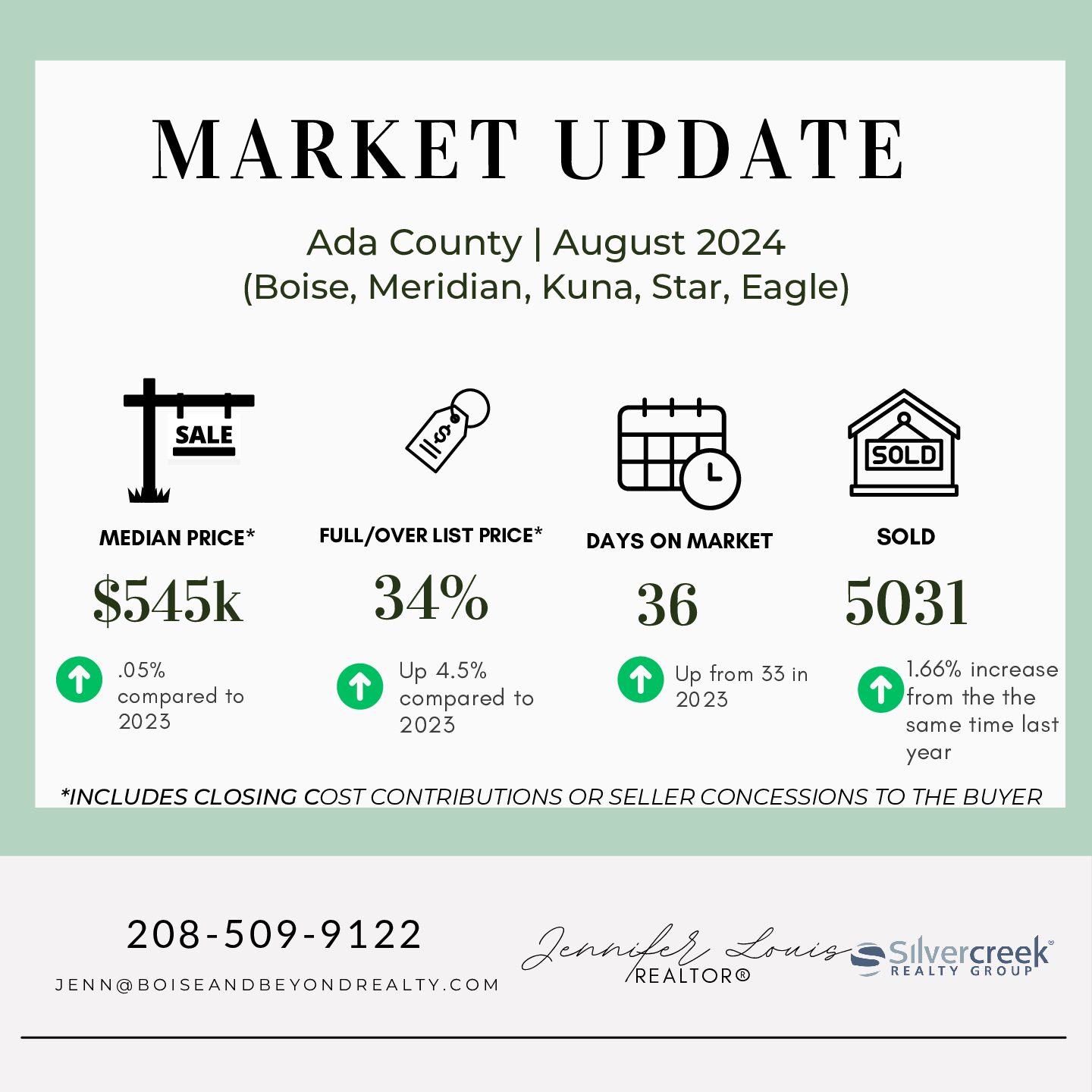

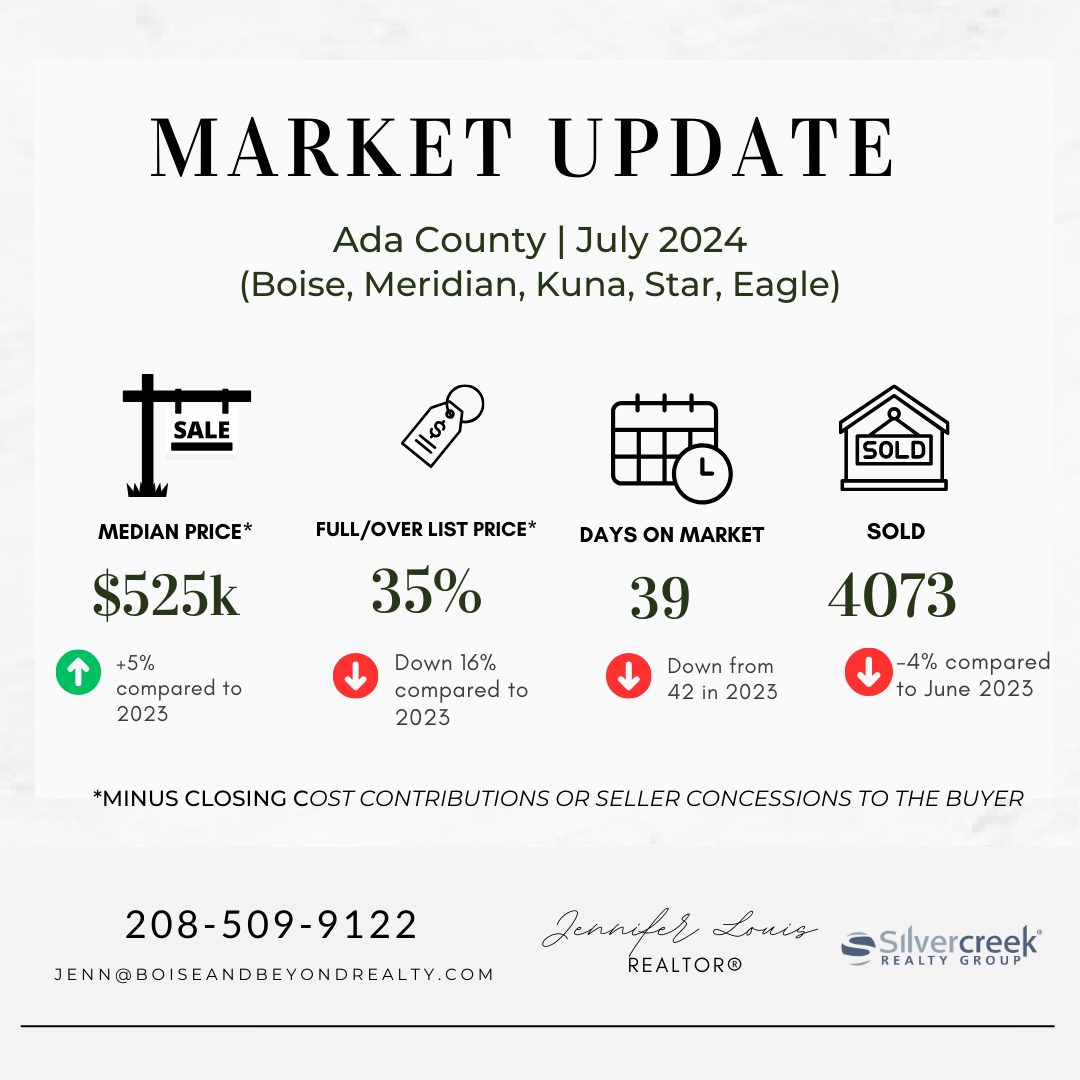

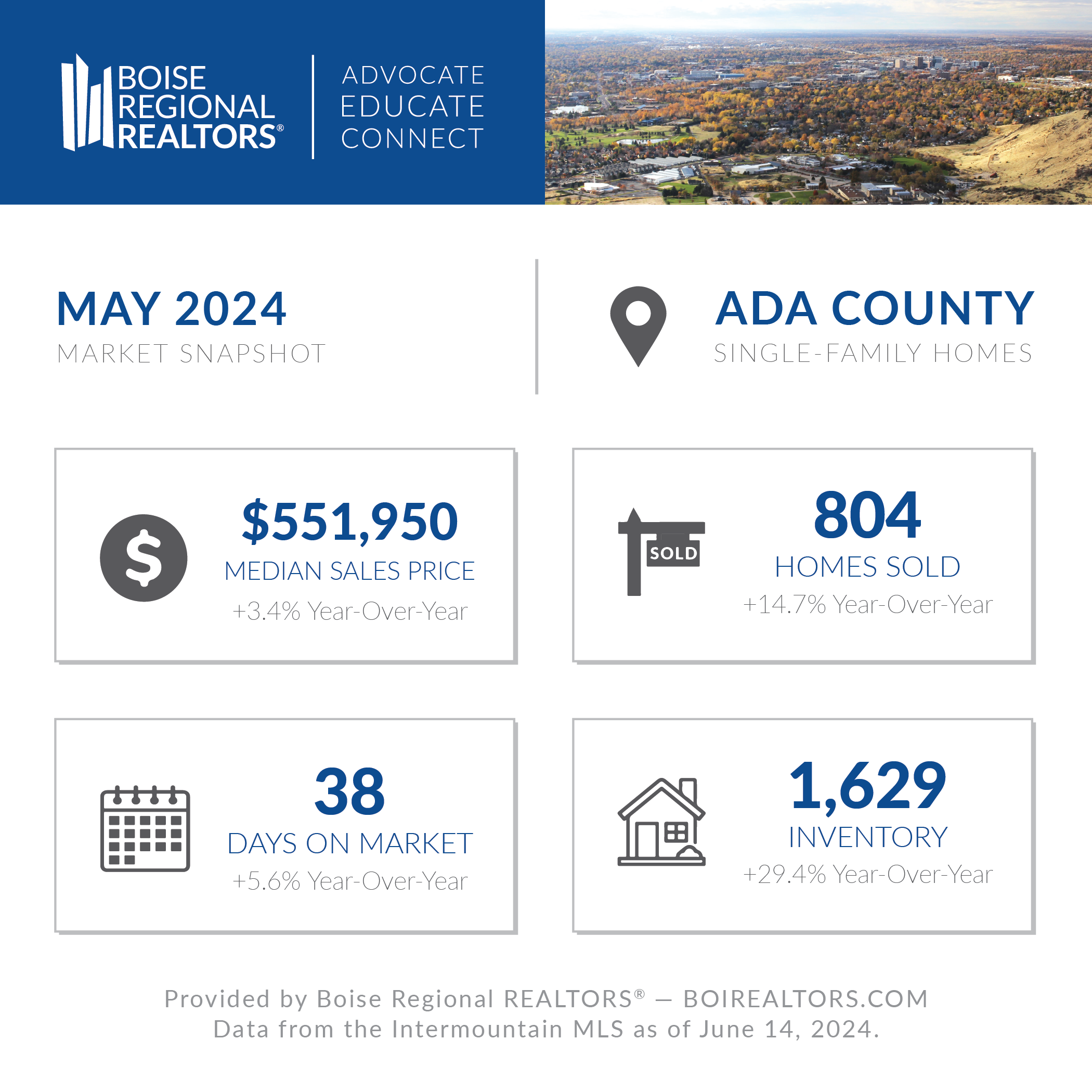

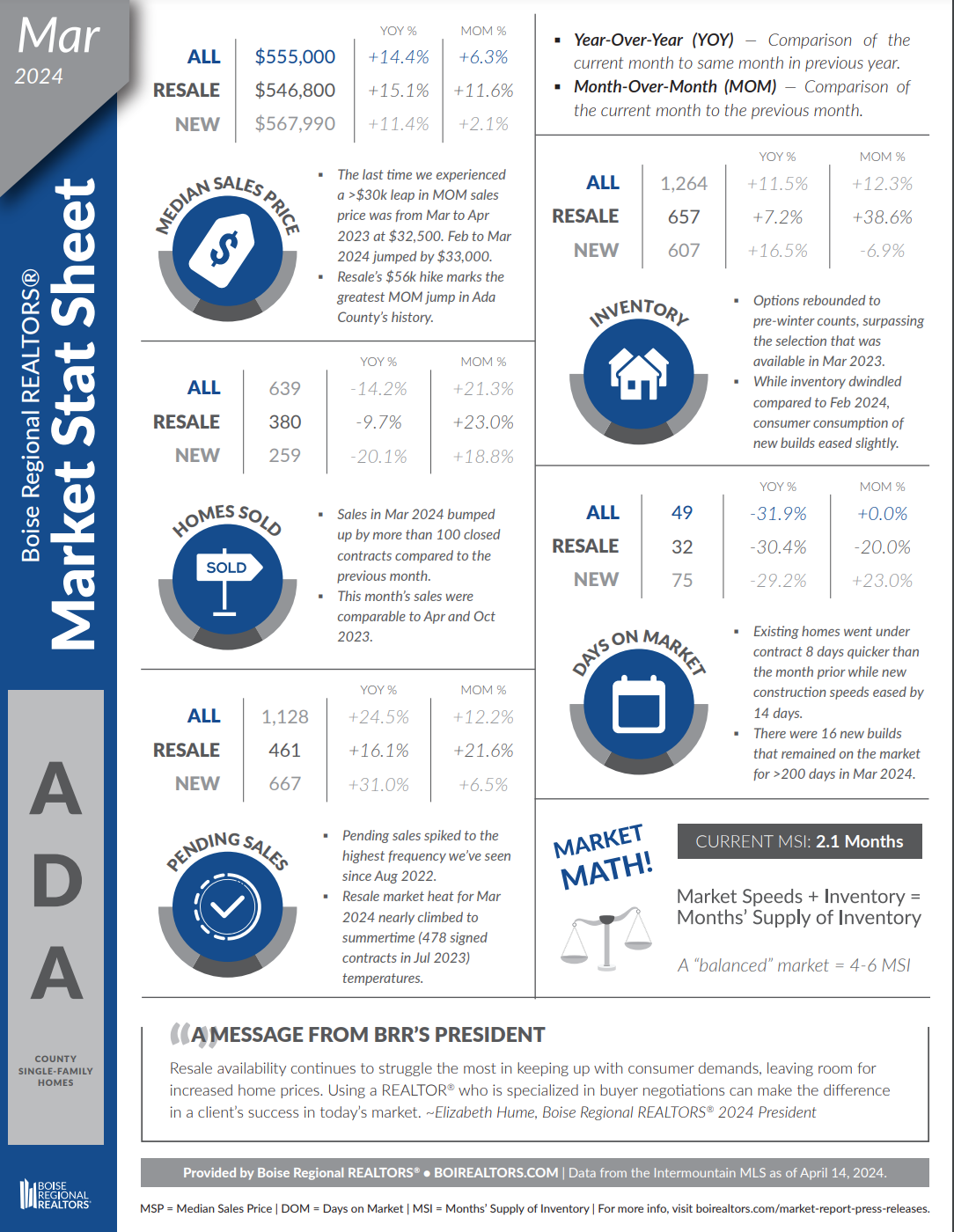

Ada County Trends in Selling Prices

In 2024, approximately 34% of homes in the Boise metro area sold for full asking price or above, up from about 29% in 2023. This indicates a competitive market where well-prepared homes are in high demand. Moreover, the median home price in Ada County has reached $545,000 for both resale and new construction, highlighting the increasing value and investment buyers are willing to place in quality properties.

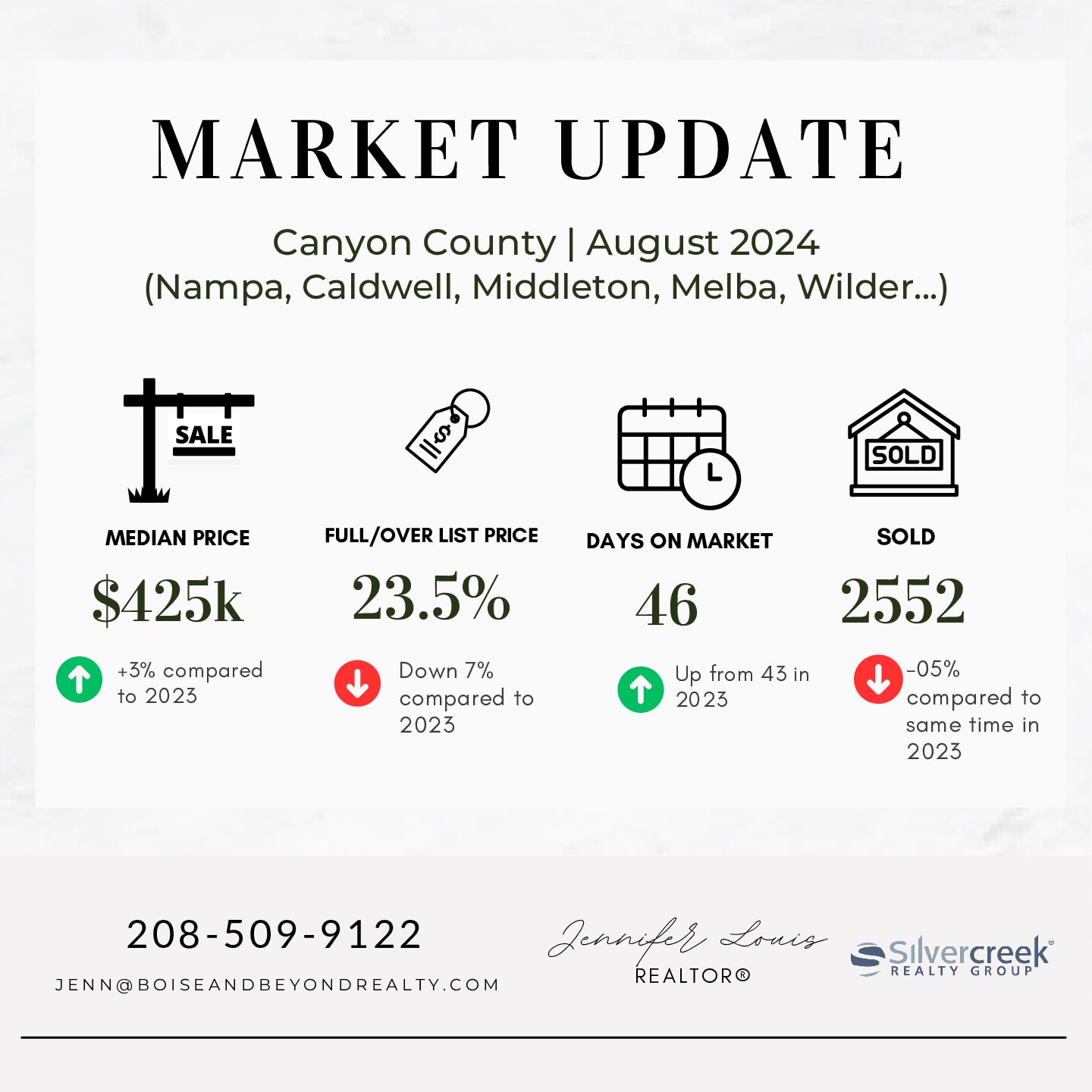

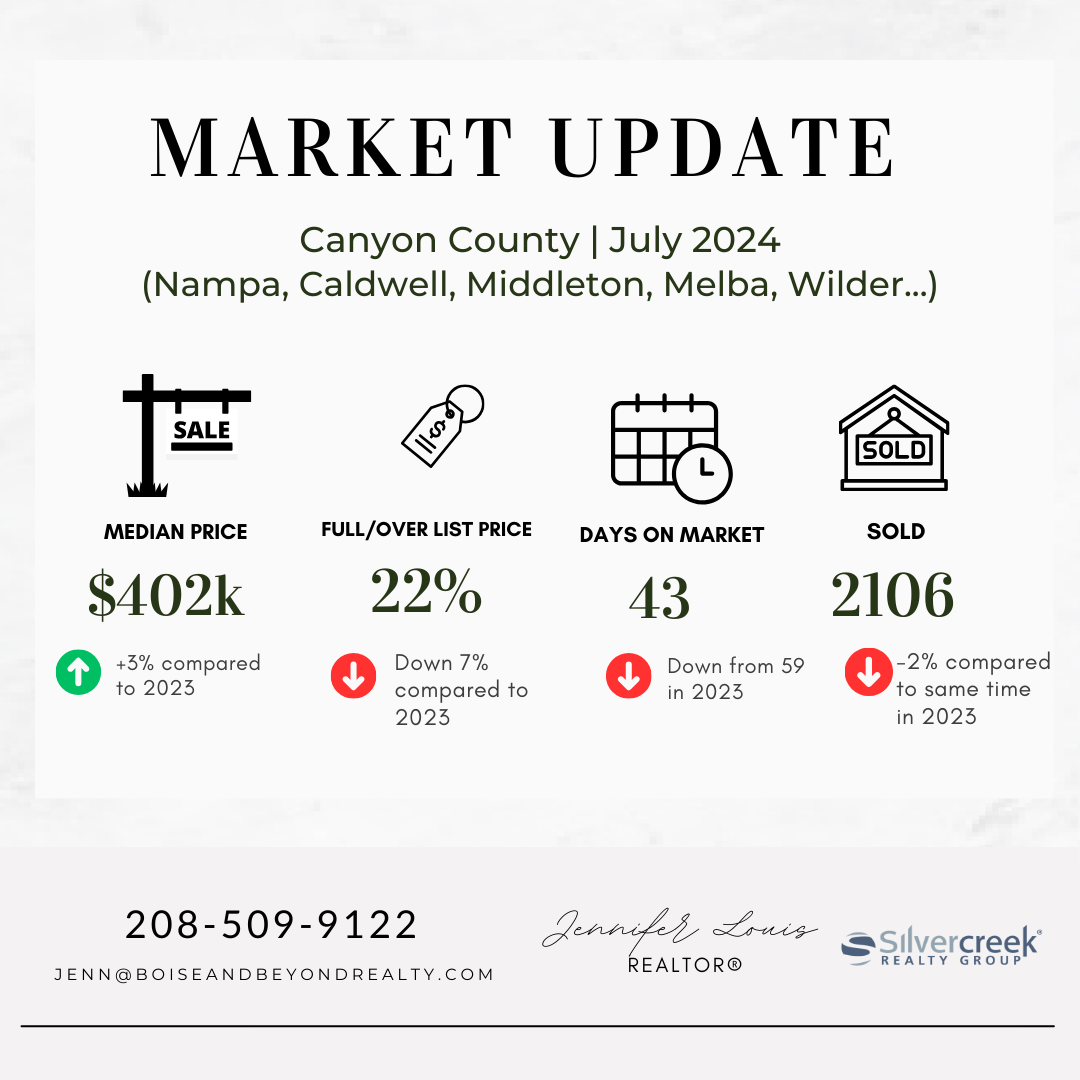

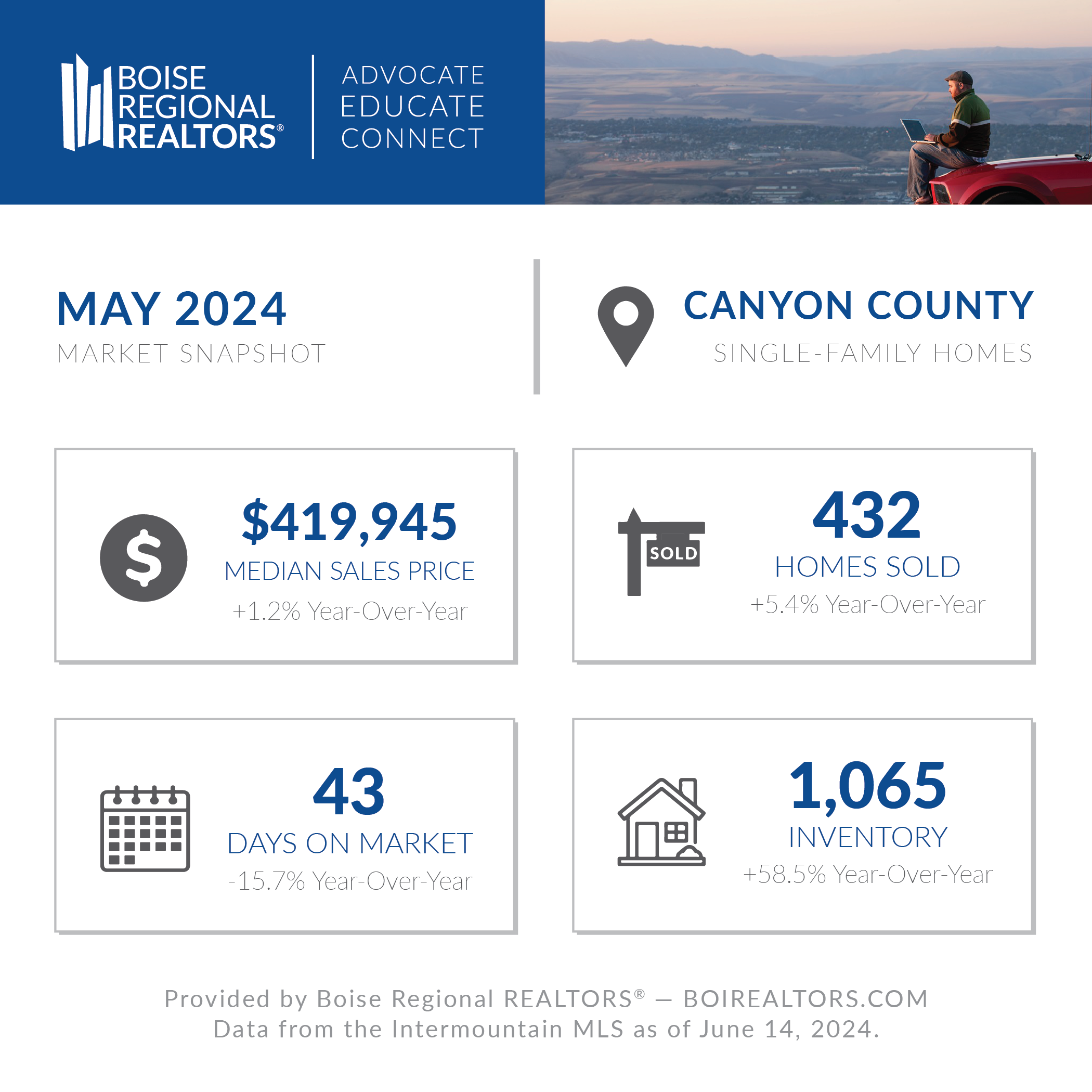

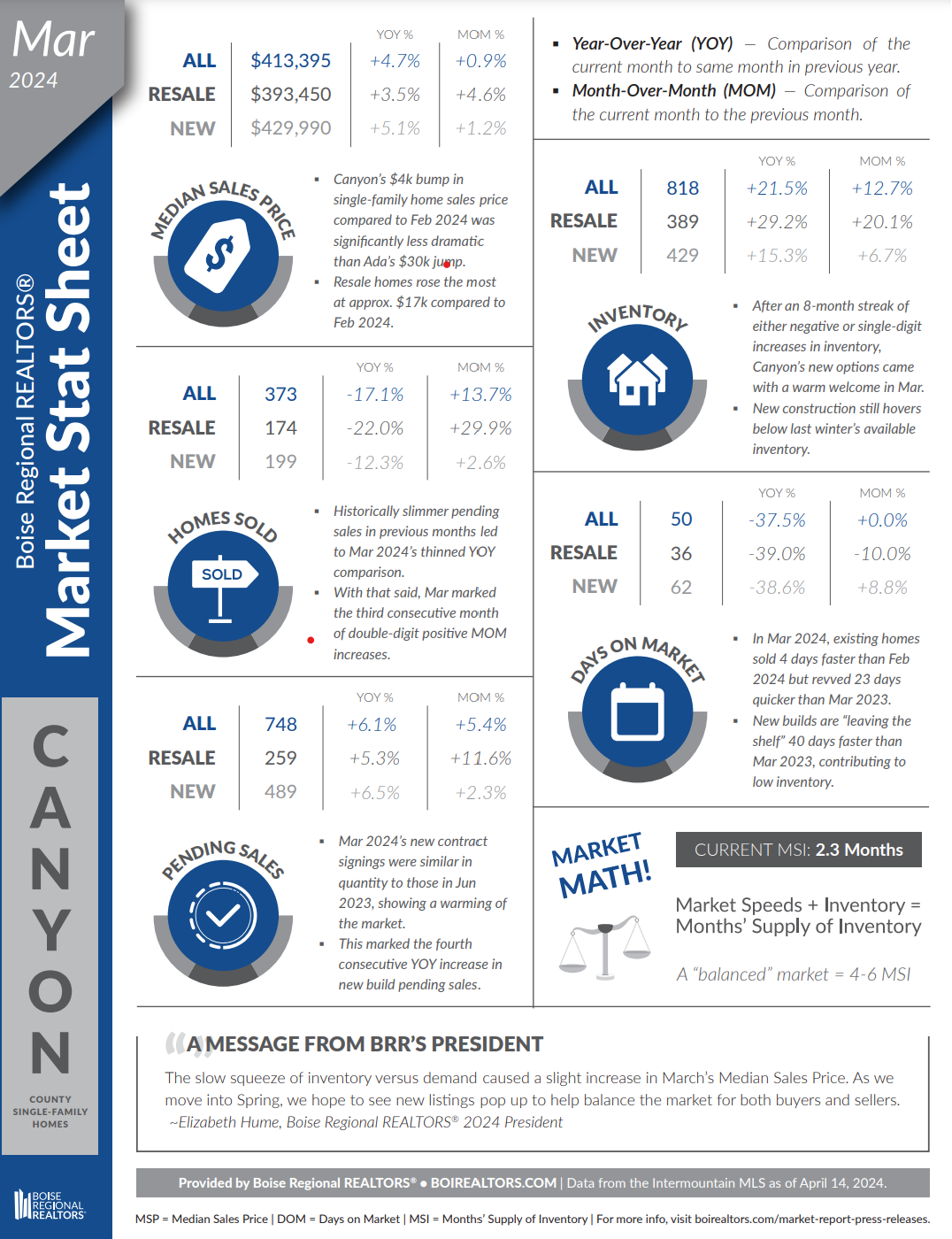

Canyon County Market Snapshot: 2023 vs. 2024

In Canyon County, the market has shown notable changes from 2023 to 2024:

- 2023 Overview:

- Median Final Sales Price: Approximately $395,000

- Average Days on Market (DOM): Around 43 days

- Homes Sold at or Above Asking Price: 21.9% of homes achieved this mark, with 559 homes selling at or above the listed price after considering closing costs.

- 2024 Overview:

- Median Final Sales Price: Approximately $425,000, marking a 4.9% increase from 2023.

- Average Days on Market (DOM): Decreased to about 57 days.

- Homes Sold at or Above Asking Price: 23.5% of homes sold at or above the original asking price after accounting for closing cost contributions.

These figures from Canyon County demonstrate a robust but slightly less heated market compared to Boise, with homes taking longer to sell but still fetching competitive prices.

Cash Transactions vs. Mortgage Purchases

The proportion of homes purchased with cash has notably risen, indicative of robust investor interest and a significant segment of buyers looking to bypass the complexities of mortgage financing. This trend influences market dynamics, often leading to quicker closing times and potentially fewer contingencies.

Impact of Interest Rates

Current mortgage rates have dipped to around 6.125% for a 30-year fixed mortgage, a decrease from last year’s average of nearly 6.94%. This reduction in rates has potentially increased buyer affordability, allowing more people to enter the market and existing homeowners to consider upgrading. The expectation of further rate cuts by the Federal Reserve could continue to foster this buying enthusiasm.

Looking Ahead

As we progress through 2024, potential buyers are advised to take advantage of the lower interest rates, while sellers might want to capitalize on the high demand, especially for homes that align with modern buyer preferences. Both parties should remain vigilant about shifts in economic indicators and Federal Reserve policies, which could impact mortgage rates and overall market conditions.

Conclusion

The Boise and Canyon County real estate markets remain dynamic and promising, with opportunities for both buyers and sellers. Staying informed about these trends and aligning strategies accordingly will be key to navigating this active market successfully. Whether you’re planning to buy your dream home or seeking to sell at a competitive price, the current market conditions offer favorable prospects for informed and proactive participants.

Talk to an Expert

In a fluctuating market, it’s essential to consult a real estate professional who deeply understands local dynamics. Online opinions and advice from acquaintances may be well-intentioned but can lead to costly mistakes. For personalized guidance on navigating Boise and the wider Treasure Valley market, consider scheduling a consultation with Jennifer Louis, your Boise Metro Area Real Estate Expert. Contact me at (208) 509-9122 or via email at [email protected] To set up an appointment. Set an appointment today to understand the market trends in Boise and the surrounding Treasure Valley with Jennifer Louis, Boise Metro Area Real Estate Expert at (208) 509-9122 or [email protected].

Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.

Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.