Boise Real Estate Market Trends June 2025

Nearly six months into 2025, let’s delve into the market data to see where residential real estate is heading for the remainder of the year in both Ada and Canyon Counties. Both areas are experiencing a shift. The data is showing the majority of homes are selling under the asking price, however, we have seen a slight uptick in pricing in both Ada and Canyon Counties compared to 2024. Let’s dive into the Boise Real Estate Market Trends for June 2025.

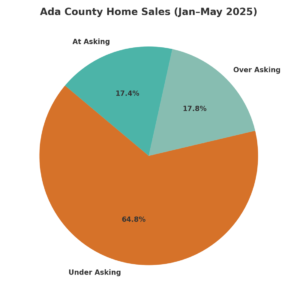

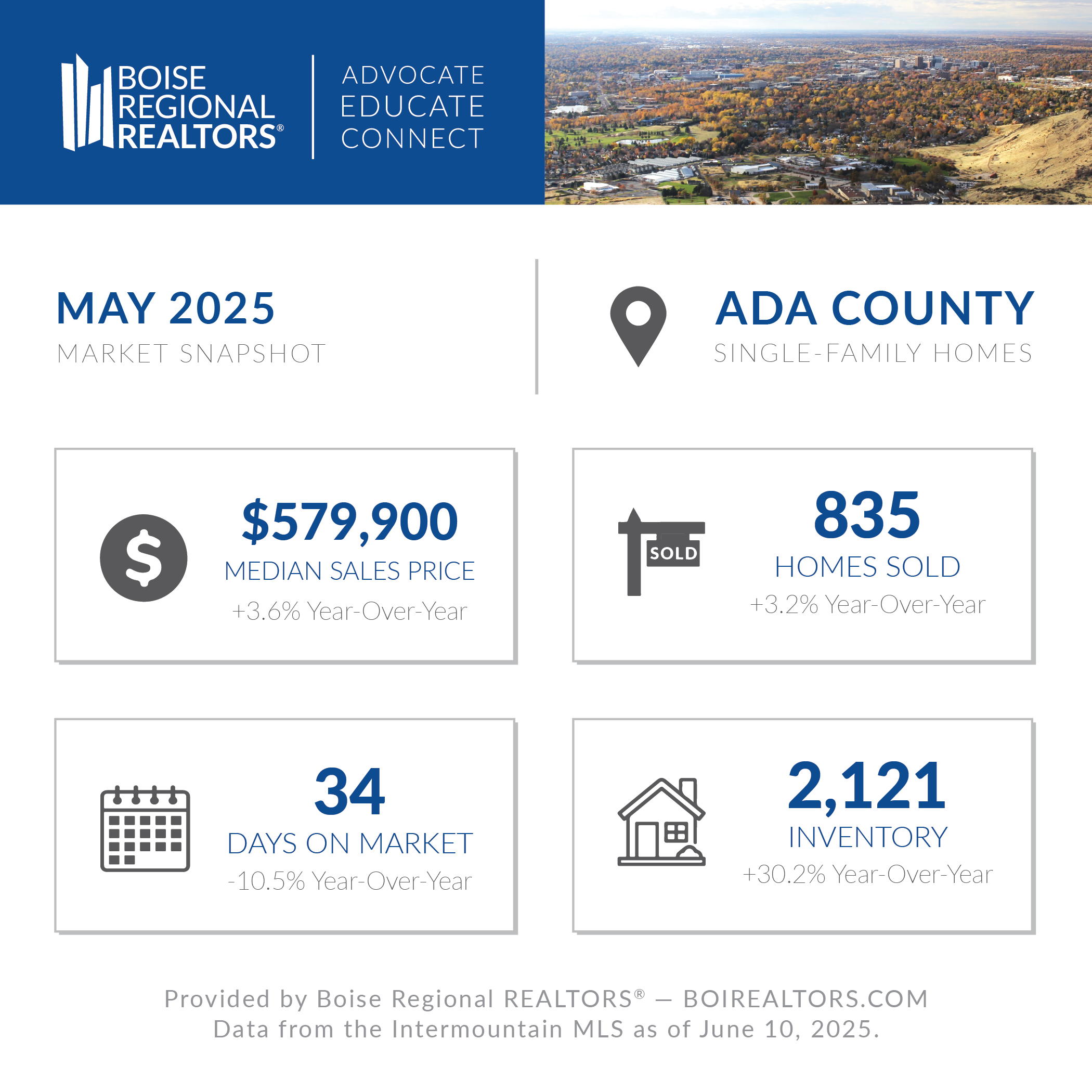

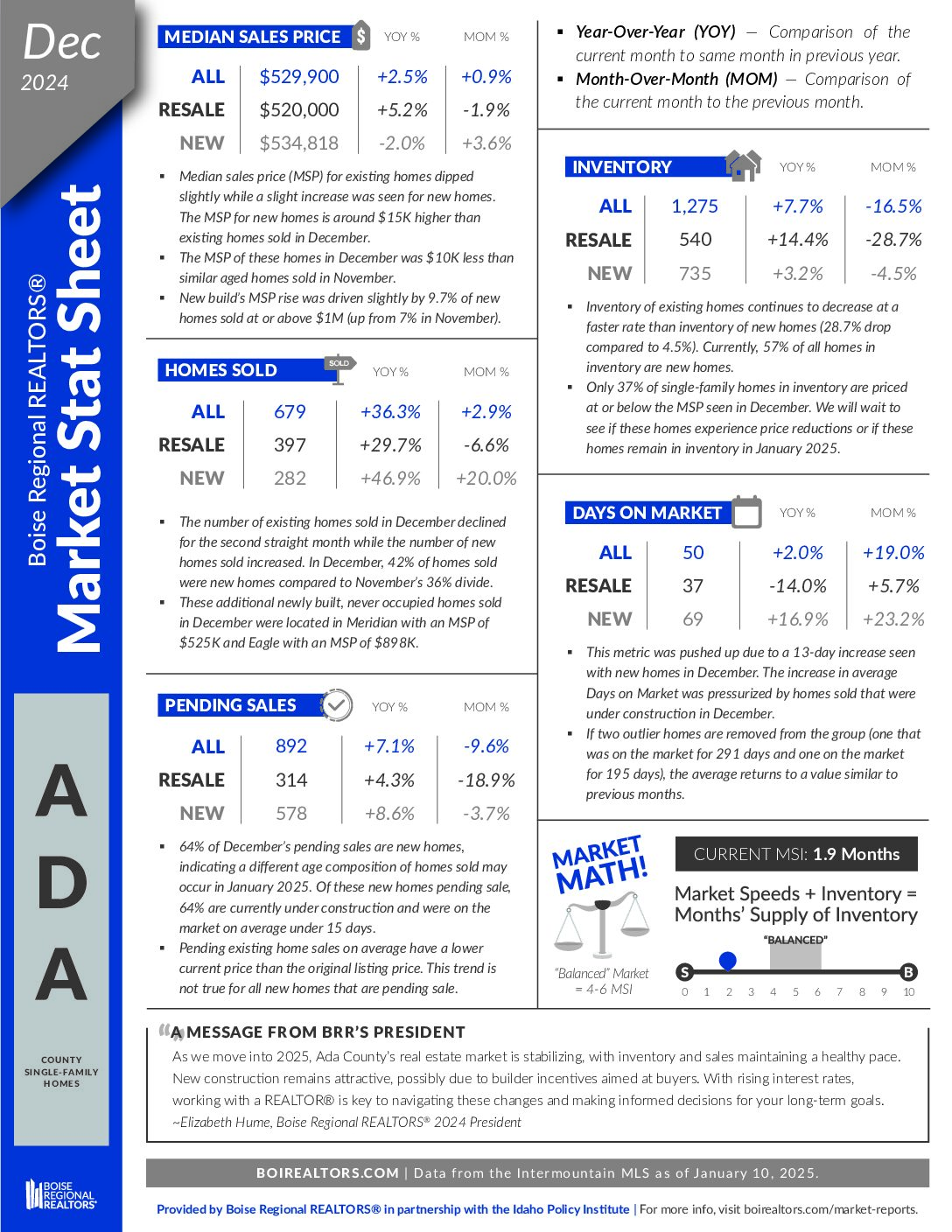

Ada County Trends in Selling Prices

As of June 2025, the median sales price in Ada County was $579,900, a 3.6% increase from last year, according to the Boise Regional Realtors. However, we’re also seeing a 30% increase in inventory compared to 2024, and fewer sales. More homes on the market with fewer buyers means longer days on market and more price negotiations.

So, how can prices be up when supply is outpacing demand? The answer lies in early 2025. A wave of buyers relocating to Boise, Idaho, that held off in 2024 entered the market in February and March, pushing prices upward temporarily. Since then, interest rates have remained high, and buyer activity has tapered off.

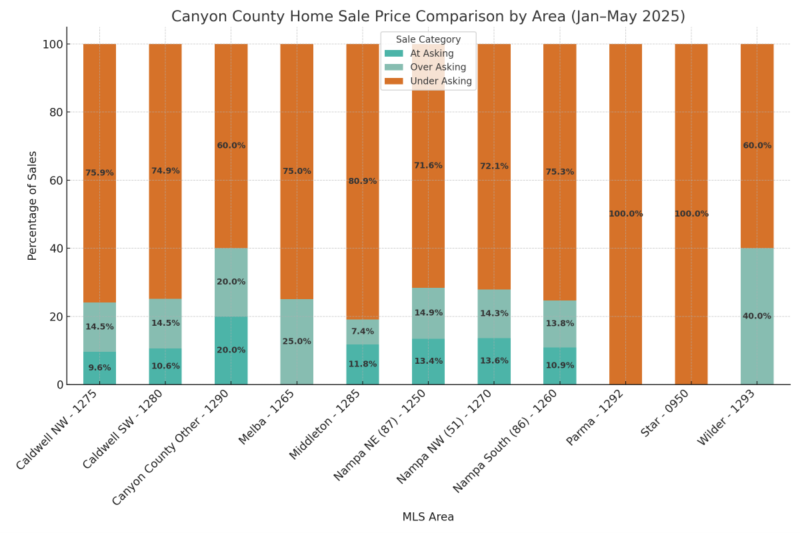

By April and May, buyers gained more leverage. Overpriced homes lingered, and many sellers began offering concessions to close deals. Our analysis of sales data shows how final prices compare to original list prices, factoring in seller-paid closing costs.

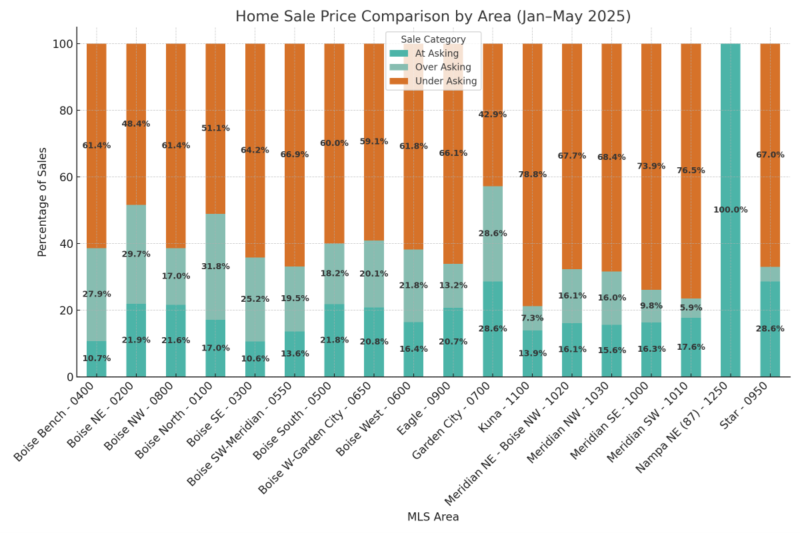

Market performance also varies by neighborhood. Some of Boise’s popular neighborhoods, such as Boise’s North End, Northeast Boise, and Garden City, saw more homes sell at or above asking compared to other parts of the county. This reinforces a key point: location matters. Homes that sold at or above asking typically featured:

Desirable locations (near Downtown, the Greenbelt, or key amenities)

Major updates such as new roofs, HVAC systems, updated kitchens/baths, or flooring

Priced under $450,000, especially for single-family homes

Value-add features like ADUs, shops, or income potential In Ada County, around April and May, buyers began to gain more leverage. Homes priced too high are staying on the market longer, and many sellers are offering concessions to close deals. We analyzed sales data to understand how final sales prices compared to original list prices, factoring in any seller-paid closing costs.

In Ada County, around April and May, buyers began to gain more leverage. Homes priced too high are staying on the market longer, and many sellers are offering concessions to close deals. We analyzed sales data to understand how final sales prices compared to original list prices, factoring in any seller-paid closing costs.

Ada County saw a 3.6% increase in price over 2024.

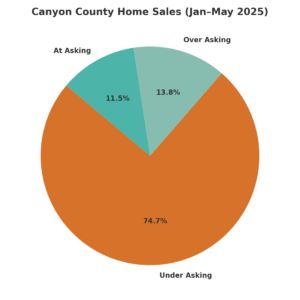

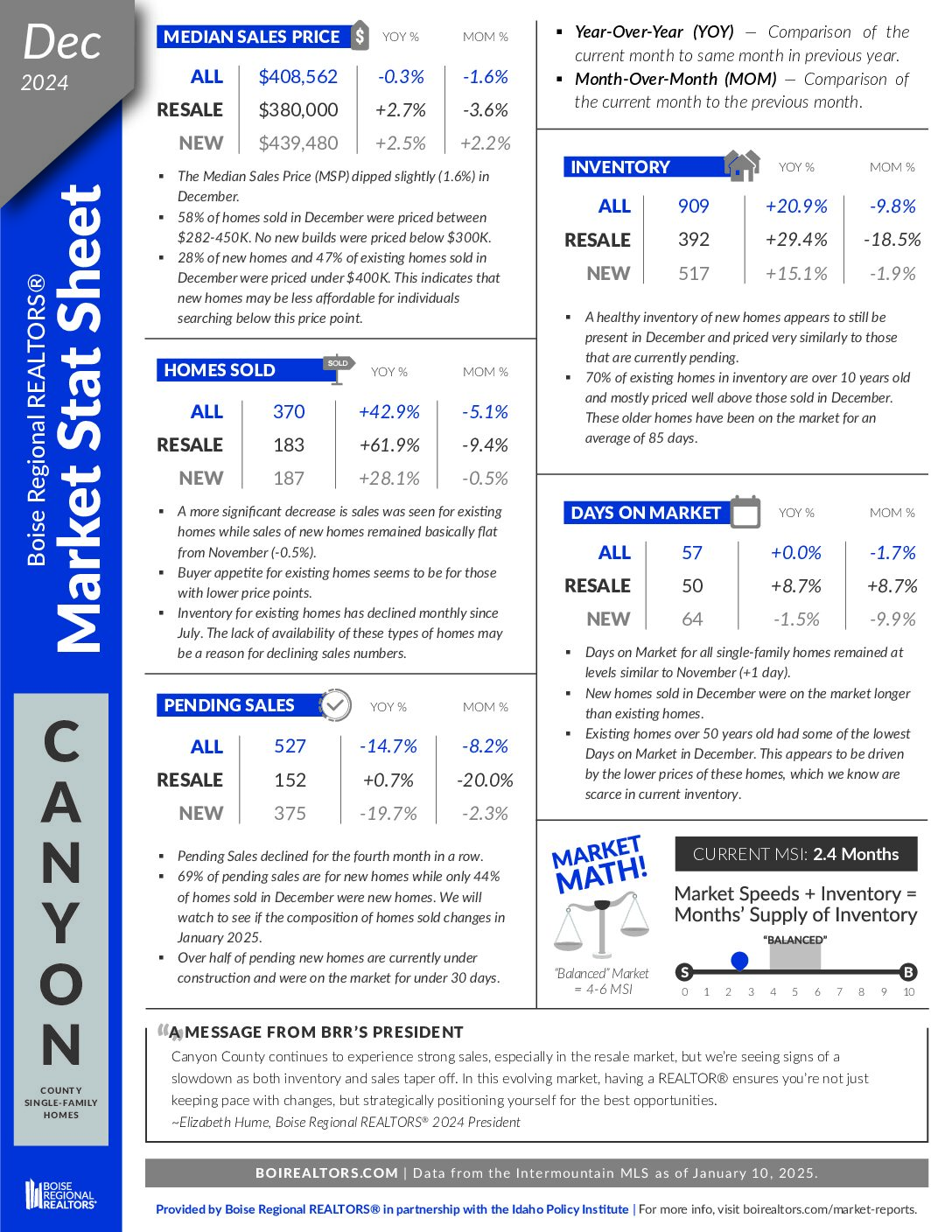

Canyon County Market Snapshot June 2025

In Canyon County, trends mirror those in Ada—many homes sold under asking, but areas with ongoing new construction showed more stability.

In Canyon County, trends mirror those in Ada—many homes sold under asking, but areas with ongoing new construction showed more stability.

A Note for Buyers:

Rising construction costs are on the horizon. Due to new tariffs (25–50%) on steel, lumber, and other materials, we could see an $11,000+ increase per new home starting mid-2025 through 2026.

However, right now, builders are eager to offload spec inventory, often offering valuable incentives—credits for upgrades, rate buydowns, closing costs, and even discounted prices. This makes it a great time to explore new construction in Canyon County while builder prices remain steady.

As of May 2025, the median sales price in Canyon County was $433,490, a 3.2% increase over last year. But inventory is up 10%, and days on market have increased 4.4% since April. Buyer activity has slowed, leading to more homes selling below list price and more frequent seller concessions. In fact, about 75% of homes in Canyon County sold under asking in the first five months of 2025.

Canyon County saw a 3.2% increase in median price over 2024

Trends and Predictions for 2025

While both counties have seen modest year-over-year price increases, market conditions are shifting.

-

Interest rates are expected to remain in the high 6% to low 7% range, keeping affordability tight

-

Home prices are likely to remain flat, or dip slightly as days on market increase

-

Buyer hesitation is growing, especially among those waiting for price or rate drops

Boise remains a desirable place to relocate, but challenges in other states, like homeowners struggling to sell, will impact demand here. The market may feel locally strong, but it’s not immune to national economic pressures, including inflation, tariffs, and uncertainty.

What to Know if You’re Relocating to Boise

New Construction: Material costs are volatile. Lock in pricing early and take advantage of builder promos while they last.

Interest Rates: If you see a dip, act quickly. Even small reductions can improve affordability significantly.

Relocators & First-Time Buyers: Boise’s lifestyle is a big draw, but keep an eye on mortgage trends.

Tactic to Consider: Negotiate for seller concessions to cover closing costs or buy down your rate.

Buyers should consider asking for seller concessions to buy down their interest rate or cover closing costs to make home buying more affordable.

How to Sell a Home in Boise

This is a market that requires smart pricing and patience. Overpriced homes risk sitting on the market and ultimately selling for less.

Here’s how to stand out:

Effective Marketing – High-quality photos, strategic social media, and targeted exposure are essential

Timing – Avoid listing during slow seasons like the holidays or when competing inventory is high

Strategic Pricing – Homes priced competitively or slightly below the competition often sell faster and closer to the asking price

Hire an Expert – Work with an agent who understands your neighborhood and knows how to market to those relocating to Boise, and in today’s more selective environment.

Boise Real Estate Trends June 2025 Summary

As we navigate through 2025, staying informed and adaptable is key. Buyers have more negotiating power, and sellers must approach the market with a clear strategy. With stable prices and valuable incentives available, now could be the right time to make a move, whether you’re buying your first home or selling a long-time residence.

Partner with an experienced real estate professional who understands the local market and can guide you through this evolving landscape. Let’s talk in detail about the Boise Real Estate Market Trends in June 2025.

Talk to a Top Boise Real Estate Agent

In a fluctuating market, it’s essential to consult a Boise real estate expert who deeply understands local dynamics. Online opinions and advice from acquaintances may be well-intentioned, but can lead to costly mistakes. For personalized guidance on navigating Boise and the wider Treasure Valley market, consider scheduling a consultation with Jennifer Louis, your Boise Metro Area Real Estate Expert. Contact me at (208) 509-9122 or via email at [email protected].

Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.

Jennifer Louis, Boise Area Real Estate Expert is a relocation specialist for Boise and the Treasure Valley. Helping hundreds succeed in finding their perfect home while simultaneously assisting homeowners to prepare and sell their homes.